Traveling abroad can be a complete hassle if you’re not prepared for it. If you’re traveling overseas and using your current credit card, you might have a lot of extra charges for using the card outside of the country.

In many cases, many people opt to apply for a new credit card that will cater to their traveler’s lifestyle. The Barclaycard Miles & More World Elite Mastercard is the best option for those who are frequent travelers and want the best experience while traveling.

Check out the article below to learn the many reasons why the Barclaycard Miles & More World Elite Mastercard stands out.

Why Barclaycard Miles & More World Elite Mastercard Stands Out

The Barclaycard Miles & More World Elite Mastercard is one of the few travel rewards credit cards that allows you to travel in style and comfort.

There may be a lot of other credit cards out there that focus on travel, but there is none that can compare to what this credit card offers.

Here are some of the reasons why the Barclaycard Miles & More World Elite Mastercard stands out.

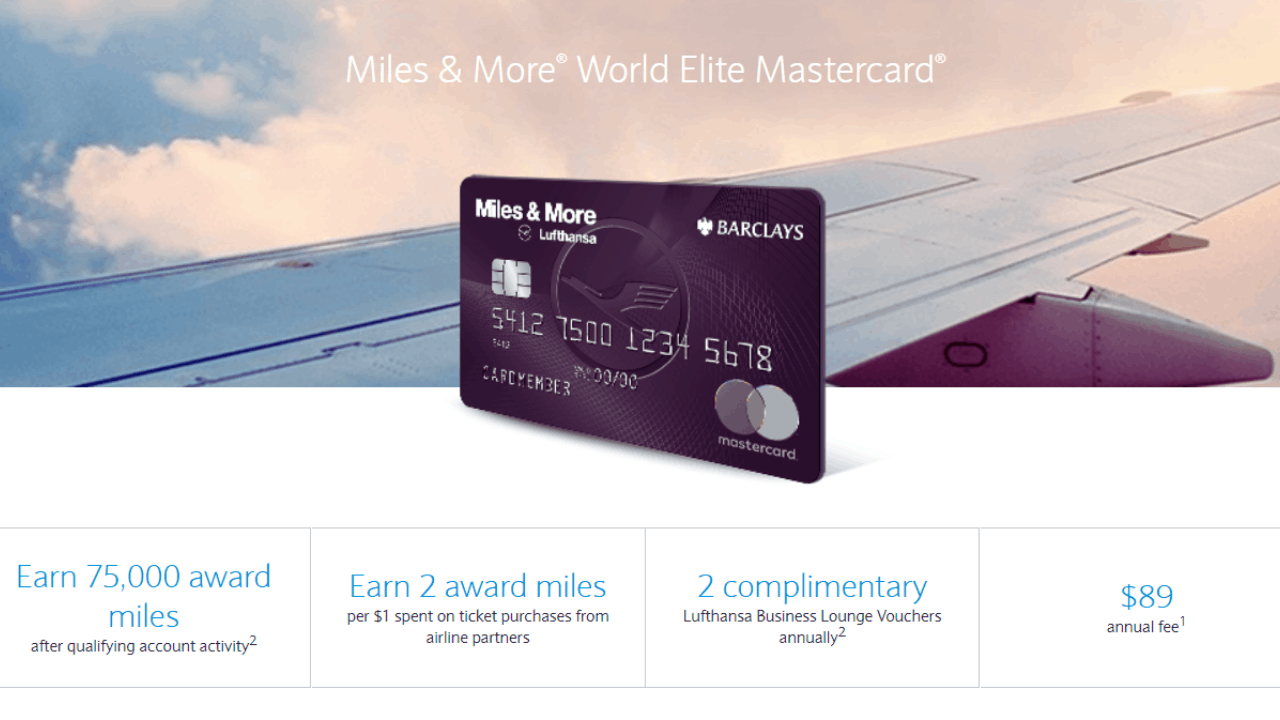

Get 60,000 Award Miles as a Welcome Bonus

You get a very generous reward right off the bat with the Barclaycard Miles & More World Elite Mastercard.

Once you are approved for the card, you can receive as much as 60,000 Award Miles if you spend a minimum of $3,000 in purchases and pay your annual fee within the first 90 days of opening the account.

This will help give you an immediate boost to the amount of miles that you get.

Earn Award Miles and Redeem Rewards

Speaking of miles, the Barclaycard Miles & More World Elite Mastercard lets you earn 2 Award Miles per dollar spent on tickets directly purchased from partner airlines.

You then get 1 Award Miles per dollar that you spend on any other purchase made with the card. It’s an exciting prospect that you get to have this amazing amount by just swiping your card for every travel purchase that you make.

You can then redeem your miles for discounts and upgrades on your next trip.

Travel in Style

With the Barclaycard Miles & More World Elite Mastercard, you get to travel in style with the two complimentary Lufthansa Business Lounge Vouchers after your first year of using the card.

This is a great way to celebrate your anniversary with your loyalty to the credit card by allowing you to be more comfortable and convenient when traveling.

Don’t forget to unlock this feature when you reach this milestone.

Low Introductory APR Period

What’s great about the Barclaycard Miles & More World Elite Mastercard is the low introductory APR period, which gives you the incentive to use the card as early as possible.

You have a 0% introductory APR for the first 15 billing cycles before it reverts to 21.24% to 29.99%, depending on your creditworthiness.

Take this time to consolidate your balances and start new with this credit card.

Check Out These Charges

Apart from the low introductory APR period, the Barclaycard Miles & More World Elite Mastercard also has a 21.24% to 29.99% variable APR for purchases.

Cash advances will have an APR of 29.99% with a balance transfer fee of either $5 or 5% of the total amount of balance transferred.

There is also an annual fee of $89, which covers the maintenance as well as the features of the card.

Is the Barclaycard Miles & More World Elite Mastercard Right for You?

After reading all of those reasons, you might wonder if the Barclaycard Miles & More World Elite Mastercard is the right credit card for you.

The quick answer is yes. If you’re a frequent traveler who wants to experience less hassle and more comfort and convenience abroad, this amazing credit card is the right fit for you.

Not every credit card is right for everyone, but you can always choose the best out of the bunch.

The Barclaycard Miles & More World Elite Mastercard is the best out of the entire market when it comes to sustaining a traveler’s lifestyle.

Contact Details

If you wish to contact their customer service hotline for support, you may dial the number 877-523-0478, and a bank representative will be with you to provide you with assistance.

You can also call the number to ask for an update regarding your application for the credit card.

You can also visit their main office in the UK at 1 Churchill Place, London E14 5HP, or 125 South West Street, Wilmington, DE 19801 in the US.

Barclaycard Miles & More World Elite Mastercard FAQs

When it comes to the Barclaycard Miles & More World Elite Mastercard, there might be some inquiries about the card that you want answers to.

Here are some of the most frequently asked questions regarding the credit card.

How to Apply for the Barclaycard Miles & More World Elite Mastercard?

Applying for a credit card is easy. Head over to the official website and select the card.

Review all the details and the terms and conditions, then click on Apply. Complete the online application form and submit it.

Wait for the approval of your application, and the credit card will be sent to you by mail.

How Will I Know if the Barclaycard Miles & More World Elite Mastercard is a Good Credit Card?

You’ll immediately know that the Barclaycard Miles & More World Elite Mastercard is miles better than many other travel rewards credit cards based on the amount of rewards that you get.

The fact that you get 60,000 Award Miles from just opening your account immediately offsets the annual fee and any other charges that you receive with the card.

Apart from its amazing perks and features, this makes it a good credit card to have.

What is the Credit Score Requirement to Apply?

You will need to have at least a good credit score of 580 and above to qualify for the Barclaycard Miles & More World Elite Mastercard.

Make sure that you have achieved this credit score before applying to increase your chances of getting approved and have a better interest rate.

Conclusion

The Barclaycard Miles & More World Elite Mastercard appeals primarily to frequent travelers. Still, with its ability to allow you to earn miles even with many other transactions, you can easily collect miles and use them for your next trip. Having this credit card when traveling abroad makes purchases and transactions a lot easier and more affordable, making it one of the credit cards that truly stand out.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.