Credit cardholders know that when applying for a credit card, we often look for features and perks that will let us keep using the card for a long time. One such feature is the introductory offer, and some have special introductory rates that last for several months.

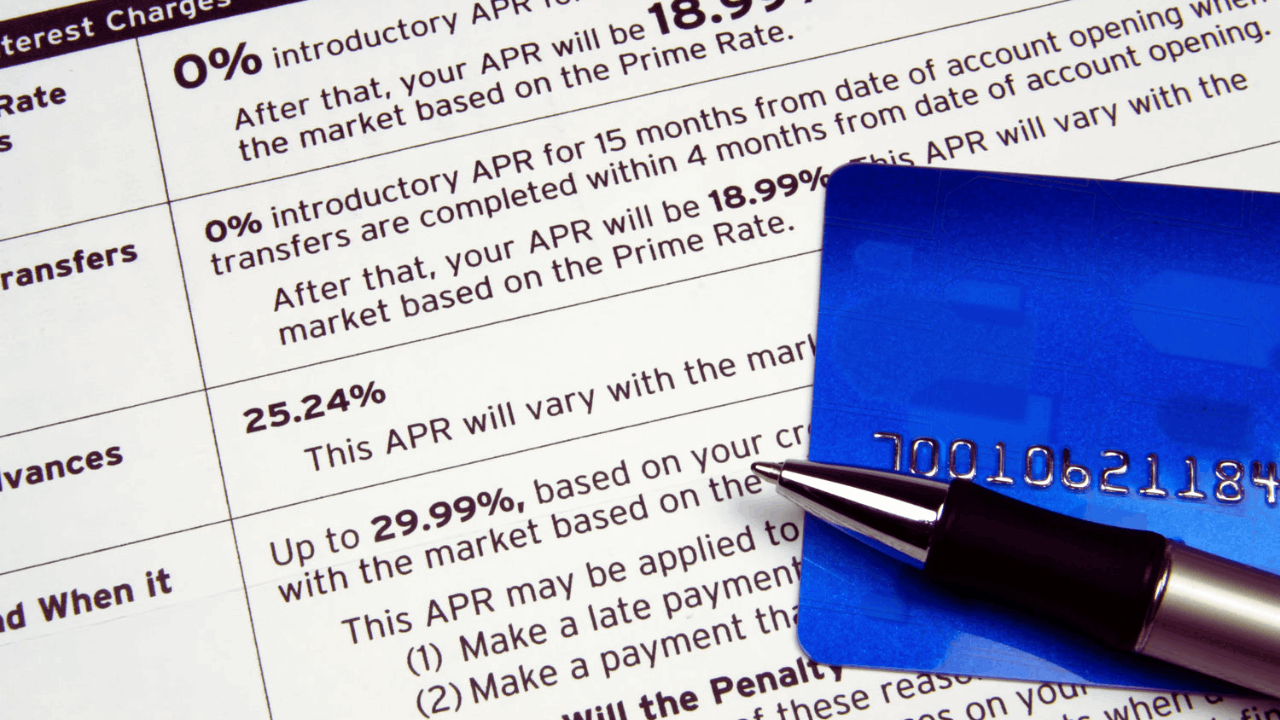

These introductory offers usually last for a limited time after you have been approved for the credit card. They are often given to you as either zero percent or a small percentage of the interest rate. Many cardholders take advantage of this offer to avoid paying a large amount for their interest fee.

But what do you do with this introductory offer, and how do you determine if these credit card introductory offers are legit? Check out the guide below to learn more about the ins and outs of credit card introductory offers.

Check the Time Frame of the Offer

One thing you need to check on introductory offers is the time frame. As mandated by law, introductory rates must always be longer than six months.

This is the reason why you often get these offers for more than 12 months and some can even go as long as 18 or 20 months.

Many credit card issuers also use billing cycles instead of months. Remember that billing cycles vary differently from month to month so you need to have this clarified with your issuer.

Only accept credit card offers when you know the overall length of the offer so you can focus on paying your balance.

Make Good Use of Balance Transfer Offers

Many credit cards often offer a 0% introductory offer on balance transfers.

This is a great way to consolidate your debt into one credit card so that you can pay it off as soon as possible.

Transferring all of your balance with a credit card that has this introductory offer for a long period allows you to save money from all other charges.

This makes paying off your debt even faster now that you don’t have to worry about any other extra expenses from your other debt.

Make a Large New Purchase

Another great thing about credit card introductory offers is that they do not charge you with any interest rate for a certain period.

This is a good way for you to make that large purchase without having to worry about any extra charges.

Check your credit card first before you complete the transaction to ensure that you won’t be charged any other fees.

Make sure that you finish off paying the entire amount before the introductory offer period ends or you’ll end up paying a good amount of extra charges.

Always Pay On Time

It comes as no surprise that when you are dealing with any credit card, you should always pay on time.

You will lose your introductory offer the moment you fail to make any payment on time.

You will also have to pay the price since your interest rate will increase to its maximum, which puts an extra burden on your statement.

Avoid exceeding your credit limit as well to prevent this from happening to your introductory offer. Make sure that you continue to monitor your offer even if you have already made a large purchase or transferred your balance.

Always Compare Intro Offers

There are so many credit cards out there that offer different kinds of introductory offers. It is very important that you already know what you want before looking at all these credit cards.

Check the introductory offers and compare them to each other.

You’ll soon discover that some cards offer a shorter 0% introductory period, while others extend for several more months but have very limited options.

You should try to weigh the things that you need based on your financial capabilities before deciding which one suits your needs best.

Take Advantage of Other Features

Many cardholders often look at the introductory offer when using the card but there is still so much more to discover.

Most of the cards that offer these offers also have a tremendous number of features, including reward points, welcome bonuses, and even specific ones like free monthly subscriptions for streaming services and other perks.

Take full advantage of these features while you’re also enjoying the introductory offer to lower your monthly credit card bill and other expenses.

Do Not Forget to Review the Terms and Conditions

As with every time you apply for a new credit card, you should always check all the features of the card including the terms and conditions.

This is where you will find all of the cards’ specifics, including the parameters, time frame, eligibility, and the minimum spend required to take advantage of the introductory offer.

Other credit cards have specific terms regarding these introductory offers so be sure to review them to prevent them from getting prematurely terminated.

Determine How Much You Need to Pay

Even if you don’t have to pay any interest during the introductory period, you still need to calculate and determine the amount that you need to pay.

This will help you pay off your monthly bill before the introductory period is done.

If possible, try to determine the amount for each month that you can fully pay off your entire purchase months before the offer is done.

This will give you some breathing room in case you’re not able to pay for a few months.

Have a Back-Up Plan

If you know that you won’t be able to pay by the end of the introductory offer, make sure that you have a backup plan a few months before the end.

You can either increase your monthly payments to try and lower the amount of interest charges.

If you still have a good credit score, you can opt for another credit card and transfer the remaining balance to give you some time.

While you may have to pay for a balance transfer fee, this can help you save more to prevent your credit score from suffering as well.

Conclusion

These credit card introductory offers are great ways for you to get a new credit card. Not only do you get some breathing room from making a big purchase or helping you pay off your debt, but you also get to enjoy using your credit card for what it offers apart from the introductory ones.