Imagine how it would feel like when you’re traveling to your destination without the hassles you normally experience at the airport. How about getting rewarded every time you use your credit card for flights and hotels?

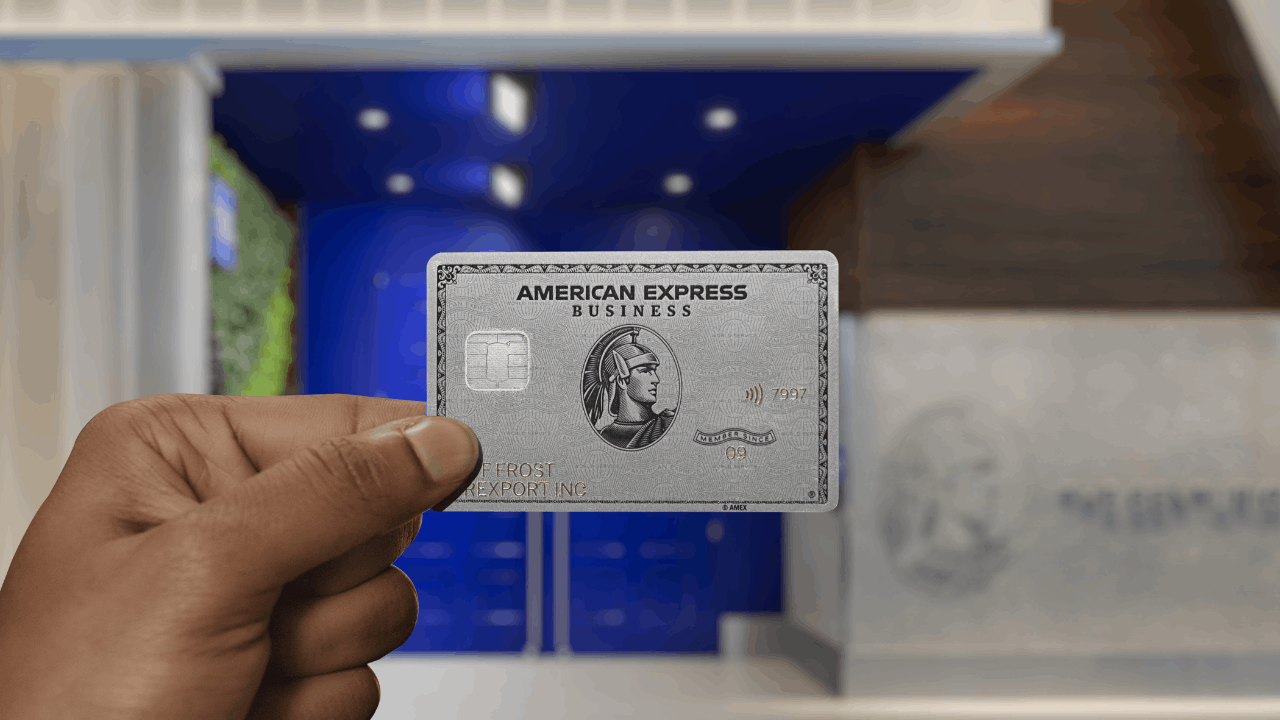

This is what the American Express Platinum Credit Card is offering to you today. This amazing travel rewards credit card gives you all of the perks and benefits you need as a frequent traveler.

If you’re looking for an amazing travel credit card, the American Express Platinum Credit Card might be the one for you. Check out the article below to learn more.

American Express Platinum Credit Card Overview

Most travel rewards credit cards often just give you a handful of perks and benefits to reel you in.

With the American Express Platinum Credit Card, you are living a different lifestyle.

The American Express Platinum Credit Card is a credit card meant for frequent travelers who want to enjoy their life while traveling or on vacation with the following features, perks, and benefits.

Benefits and Perks That You Can Enjoy

American Express Platinum Credit Cardholders can enjoy a $200 credit every year for hotel bookings at more than 1,700 partner hotels through the Hotel Collection.

You also get $200 a year for Uber, $300 a year for Equinox gym memberships, $100 a year at Saks Fifth Avenue, and a $240 credit or $20 per month for any digital entertainment platform of your choice.

These perks alone make the entire travel rewards credit card worthwhile, but there’s even more to enjoy.

Airport Lounge Access

Traveling with the American Express Platinum Credit Card is an entirely new experience.

With this credit card, you gain access to Centurion Lounges and International American Express Lounges in airports all over the world. You also gain access to Delta Sky Clubs, Plaza Premium, Escape, and Airspace lounges.

You can also enroll for the Priority Pass Select lounges to further enhance your experience, especially at the airport.

Hotel Perks

With the American Express Platinum Credit Card, you also have hotel benefits in a wide array of world-class hotels.

You can enroll to upgrade your current Marriott rewards program to Elite status. You also get automatic Gold status at Hilton.

When you book a least two nights at one of the hotels under The Hotel Collection, you get an automatic upgrade and a $100 credit for different activities at the hotel.

Welcome Bonus Offer

The American Express Platinum Credit Card also gives out an amazing welcome bonus offer to all new cardholders.

You can expect to earn as much as 80,000 Membership Rewards Points when you spend $8,000 for the first 6 months of opening your account.

Check Out How to Earn Rewards

Earning rewards points is also quite easy with the American Express Platinum Credit Card, especially if you’re fond of using the card on your travels and leisure activities.

You get to earn 5 Membership Rewards points for every dollar that you spend on booked flights directly at airlines or through American Express Travel.

You also receive 5 points per dollar that you spend on booked hotels then you get 1 point per dollar that you spend on any other purchases.

Redeeming Your Rewards

Your Membership Rewards points can then be redeemed through different programs.

You can use your rewards points to redeem them for travel credits so you can save money for your next flight or hotel bookings.

Learn More About the Fees and Other Charges

A lot of people might want to check first the interest rates and other fees regarding the American Express Platinum Credit Card.

When you have this American Express credit card, you will be met with a slew of charges upon using the card.

The American Express Platinum Credit Card charges you with an annual fee of $695. The interest rate differs from one cardholder to another, so you will need to consult with the bank representative about Pay Over Time APR.

The cash advance rate is at a variable 29.99%. There are no balance transfer fees or foreign transaction fees.

Is the American Express Platinum Credit Card For You?

You might be wondering if all the extra charges are worth owning the card, especially for a prestigious travel rewards card like the American Express Platinum Credit Card.

If you want to take full advantage of all the perks and benefits of owning this credit card, this is the right card for you.

If you’re looking to travel occasionally and end up never having to touch even just one or two of the perks mentioned above, you might as well find a more affordable and suitable credit card.

How to Apply for the American Express Platinum Credit Card

Applying for the American Express Platinum Credit Card is rather easy with their online portal.

Visit their official website and submit your online application form. Don’t forget to include all the required documents.

Wait for the approval of your application through email or call. You will then receive another notification if your card has been released for delivery.

Upon receiving your card, you need to activate it through your online account.

Useful Contact Info

For more information, you can contact their customer service number at 1-800-528-4800. Their line is available 24/7, and a representative will be able to provide you with answers to your inquiries.

You can also visit any American Express branch in your area, or you can head over to their main office at 200 Vesey Street, New York, NY 10285.

There are over 41 locations all over the world, so check out which one is nearest to your area.

Conclusion

The American Express Platinum Credit Card is a very prestigious credit card that is suitable for those who want to travel comfortably. The convenience and comfort that you experience, alongside its many different perks and benefits, will make you fall further in love with this card. Check out this amazing credit card and apply today!

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.